Hargreaves Lansdown, the big name investment broker is the subject of a £5.4 billion takeover bid from a consortium of private equity firms. The current board have recommended accepting this bid which would take the company off the London Stock Exchange. In this blog we look at what Hargreaves Lansdown takeover will mean for investors.

Hargreaves Lansdown History

Hargreaves Lansdown was founded in 1981 by Peter Hargreaves and Stephen Lansdown. Initially offering financial advice, the company has grown to offer a range of investment options.

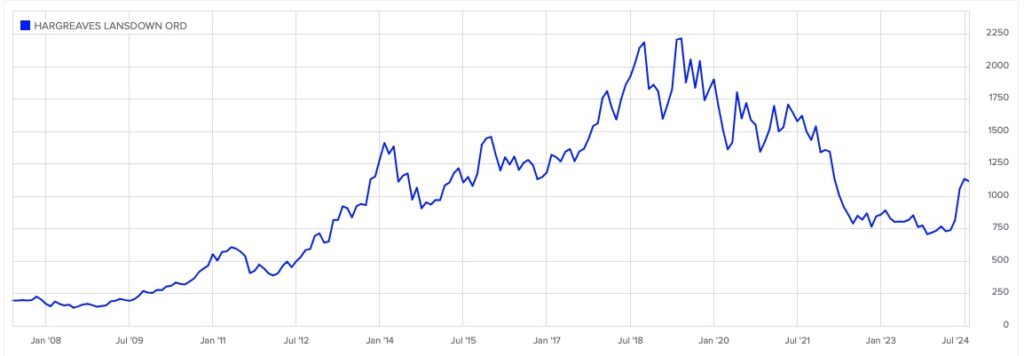

Hargreaves Lansdown was first listed on the London Stock Exchange in 2007. Since, it has seen it’s stock price rise to highs in May 2019 before dropping. Recent news about the takeover has caused an increase in share price.

Today, Hargreaves Lansdown is the number one platform for private investors in the UK. They have 1.7 million clients and are trusted with £120 billion of equity. Headquartered in Britain, the are a widely known British financial institution.

Their offerings include ISAs, General Investment Accounts, savings accounts and pensions. Of note is their Lifetime ISA (LISA), as not many brokers offer this investment option.

Hargreaves Lansdown Takeover Bid

The most recent bid for Hargreaves Lansdown has been recommended by the board. This bid is for 74% of the company. This is crucially 1% short of the 75% needed for the new owners to pass ‘special resolutions’ about how the company is run. This split means the owners will still have a say in how the company is run.

This is the 4th bid, by the consortium of private equity investors for Hargreaves Lansdown. A £4.7 billion offer was rejected in May.

The board have recommended shareholders accept the terms of this bid. The ‘firm intention’ for the offer is required to be completed 19th July. This offer will then be voted on by shareholders.

Hargreaves Lansdown Takeover Impact

Impact on the Company

Hargreaves Lansdown will be removed from the London Stock Exchange and become a private firm.

Existing shareholders may be offered the option to continue to invest, but as part of the private offering. This will make it difficult for new investors to buy.

Current investors are being offered a perceived good deal or 15% higher than the share price at the time of offer.

The company itself will continue to offer all the same services.

Impact on the UK

The Hargreaves Lansdown takeover will not have a huge impact on the UK. HL will be removed from the LSE and hence popular UK indices such as the FTSE 100 will miss out on HL’s contribution.

It’s unclear whether this signals further concern for the UK market. With popular companies such as ARM choosing to list on the NASDAQ rather than the LSE, maybe more UK companies will opt to change where they are listed or indeed be subject to takeovers from private equity firms.

Impact on Customers

There will be minimal short term impact on customers.

Whilst there will be board level changes and hence the long term direction of Hargreaves Lansdown post takeover may change, the company has been bought as it is a good revenue stream. As a result, we don’t expect the HL business model to change significantly any time soon.

Should there be changes to any of their existing products you can expect plenty of notice to be provided and options to move your investments elsewhere.

Hargreaves Lansdown Takeover Impact on You

Unless you are a current shareholder of Hargreaves Lansdown you are unlikely to notice any change at all should this takeover go ahead.

If you are a shareholder then you’ll get the opportunity to vote on the offer. If accepted, you should also get the option to transfer your investment into the then private Hargreaves Lansdown. Note if you do this you won’t be able to hold in a UK ISA.

As always, ensure your contact details are up to date with any financial institution you use. If there are any changes to products or terms and conditions HL will reach out to you.