Invest Engine is a relatively new investment platform. Offering commission free investing and no platform fees is Invest Engine too good to be true? In this deep dive we look answer the key question, is Invest Engine Legit?

Introduction

Invest Engine is a relatively new investment platform. It joins a host of new low-cost platforms like Trading 212 offering commission free investing for the masses.

In the finance world brand reputation often means a lot to customers. Big players such as AJ Bell and Hargreaves Lansdown have 30+ years of trading experience. Investing is often generational, with good (and bad) advice passed down through generations hence big brands tend to attract customers because of the trusted name.

When investing to grow your wealth, you want to be sure your money is safe. You want to pick the best broker to meet your investment goals. With Invest Engine new on the scene, offering ‘free’ investing, is Invest Engine too good to be true. In this deep dive we discuss the history of Invest Engine, whether Invest Engine is safe and critically answer the question of is Invest Engine legit?

History of Invest Engine

Invest Engine was founded in 2019 with a mission to ‘make investing simple, accessible and more powerful’.

One of the founders of Invest Engine, Simon Crookall also founded Gumtree.

Since 2019, the company has grown from a handful of employees, so still a relatively small number of 100. They now hold over £500m of assets under management and have more than 40,000 customers.

Invest Engine offer a series of products focussed on Exchange Traded Funds. Their principles of investing include investing for the long term and keeping costs down.

Since 2019 they have established themselves in the UK market, offering stocks and shares ISAs, general investment accounts and in January launched their SIPP.

They offer both a DIY investing solution where investors pick their own investments, and a managed service. The managed service incurs a small fee and Invest Engine will pick your investments for you baed on a questionnaire.

Invest Engine Regulatory Compliance

Invest Engine are regulated in the UK by the Financial Conduct Authority. They are authorised to hold client funds and participate in the pension and investment markets.

Being regulated by the FCA is a big deal. To qualify, companies must meet obligations set out by the Financial Services and Markets Act 2000. This regulatory objectives are to provide market confidence, public awareness, the protection of customers and the reduction of financial crime.

To become regulated by the FCA a series of criteria must be met. The application process required evidence to be submitted against these criteria and reviews occur regularly. Companies are obliged to report key information to the FCA to retain a license to operate. In short, companies must prove they are fit to operate in the UK.

You should never use an unregulated provider.

Invest Engine is regulated by the FCA and meets the key criteria set out in the legislation.

Invest Engine Safety

A key question for any investor is my money safe with Invest Engine? What happens if Invest Engine goes bust?

Invest Engine is FSCS protected. This means Invest Engine has no right to use your money to cover its debts and must keep customer funds separate from company funds.

In the unlikely event Invest Engine goes bust, your money will be protected up to £85,000. The Financial Services Compensation Scheme website covers this in more detail.

It is important to note that the FSCS protection only covers uninvested cash in your accounts, up to £85,000 in total across all your accounts with invest Engine.

Once you in invest your cash, your investments may go up and down in value. The more niche the ETFs you choose to invest in are, the more volatile the investments are likely to be. If you invest in a sector that crashes, then you will lose money and this loss won’t be protected in any way. This is true of investing in general.

This FSCS protection operated in the same way for pretty much all regulated investment brokers in the UK. The exception here is Trading 212 where if you chose to opt in to the high interest rates on uninvested cash, you actually invest in Money Market Funds and hence opt out of this protection.

For Invest Engine, uninvested cash is protected up to £85,000, the best protection you can get in the UK.

How Does Invest Engine Make Money?

Whilst free offerings from a company are usually good, when it comes somewhere you place your money you want to ensure a company is profitable. If not, the company is at risk of collapse which at best will cause you some inconvenience and at worst will take your money with it.

We’ve already discussed how Invest Engine is regulated in the UK so your money is safe. If you are paying no fees though, how does Invest Engine make money?

In fact with so many people questioning the legitimacy of Invest Engine and hence the profitability of the business, Invest Engine themselves issued a blog post talking about how they are able to provide a free service.

Keeping Costs Down

Invest Engine strive to keep their costs down. They approach this via a few impactful methods.

Automation

Invest Engine have a small team of approximately 100 employees. Not only does this cost less than a larger team, but it also helps drive automation. Invest Engine’s automation approach mean they can scale much more effectively that staff heavy approaches. Staff cost a lot.

Aggregation of Trading

Invest Engine is not a day trading platform. They only offer ETFs which are typically designed for long term growth as opposed to quick trades.

As a result, Invest Engine have opted to aggregate trades and only buy and sell once per day. They do this via the Retail Service Provider model. The RSP model operates as a broker between Invest Engine and the stock exchange. This is explained in the London Stock Exchange guide for private investors.

In essence, aggregating trades and using the RSP network enables better prices which keep costs down.

Limited Marketing

Much of Invest Engine’s marketing is via word of mouth and referrals. Unlike rivals such as Trading 212 who have invested in wide scale marketing online and TV, Invest Engine have stuck to cheaper options. This likely comes at the cost of slower growth, but slow and steady is often a more reliable approach.

Revenue Streams

So how does Invest Engine make money if they offer a free product?

Managed Portfolios

Whilst many customers will opt for free portfolios, Invest Engine offer managed portfolios for a fee of 0.25% a year. This is competitive with big name rivals such as Hargreaves Lansdown and AJ Bell.

SIPPs

Self Invested Personal Pensions also come with a cost. Whilst no platform fees are quite common for a stocks and shares ISA, SIPPs involve a little more work as providers need to claim tax relief from the government. As a result most providers charge a small fee.

Invest Engine charge 0.15% per annum with a cap of £200 per year. This is pretty competitive and a good revenue stream.

Uninvested Cash

Some providers such as Trading 212 will offer interest on uninvested cash in your portfolio. This can be a great incentive for customers, particularly with more complex portfolios or those who wish to trickle money into the stock market over time.

Invest Engine do not offer interest on uninvested cash. Instead they aggregate the money on the platform and earn interest on it themselves. Again, this is a great revenue stream and fairly common practice. Even those providers that do offer interest likely still make money on top of what they pay to you.

Note if you opt into free auto-reinvestment or simply purchase accumulating funds you won’t lose out on interest as you won’t have any uninvested cash in your portfolio.

Is Invest Engine Profitable?

In the UK companies are obliged to disclose certain financial information to the government. These are made publicly accessible via Companies House. Companies report financial earnings within 9 months of the end of the tax year hence the figures here are a little out of date at the time of writing.

Invest Engine Profits

Invest Engine despite growing it’s customer base has been making increasing loses over the last 5 years.

- 2019 – £772,878

- 2020 – £1,225,346

- 2021 – £2,075,121

- 2022 – £2,963,921

- 2023 – £4,624,687

Whilst worrying, this trend is often fairly common for start ups particularly in the first few years of existence. This can often be attributed to costs of creating a product and growing a customer base. In Invest Engine’s accounts, the vast majority of costs are attributed to ‘administration’ which includes paying staff wages and R&D of their product. The director’s statement recognises this loss as ‘expected during the growth phase of the business’.

By way of comparison, the very popular (and more often most costly) Freetrade made a loss of over £39m in 2022.

Invest Engine Business Growth

In more reassuring news, turnover increased from £16,783 in 2022 to £73,900 in 2023. We’re yet to see figures published for the 23/24 tax year, so hopefully there is some more promising news coming.

Invest Engine recently reported an increase in their Assets Under Management, the funds they manage on behalf of investors to over £500m. This is a 70% increase inside the last 4 months and a huge milestone for the company.

This growth can in part be attributed to the release of Invest Engine’s SIPP. Released in January, this 70% increase in Assets Under Management correlates with the 4 month period since the release of the SIPP product. This likely represents a big increase in Invest Engine’s turnover.

In the latest report, Invest Engine note they are seeking further crowdfunding with a view to continuing to cover the current losses. We may well start to see Invest Engine turn a profit in the next couple of years as their turnover will likely increase with their growth in Assets Under Management, although this may be offset by growing costs for business growth in terms of staff and growing business running costs.

Does Invest Engine Have Hidden Fees?

Usually the harder it is to find the fees, the more you’re being charged. Invest Engine are very transparent with their fees. On their website, they have a costs tab in the main menu.

Invest Engine have an informative help centre to explain the costs and charges investors will incur.

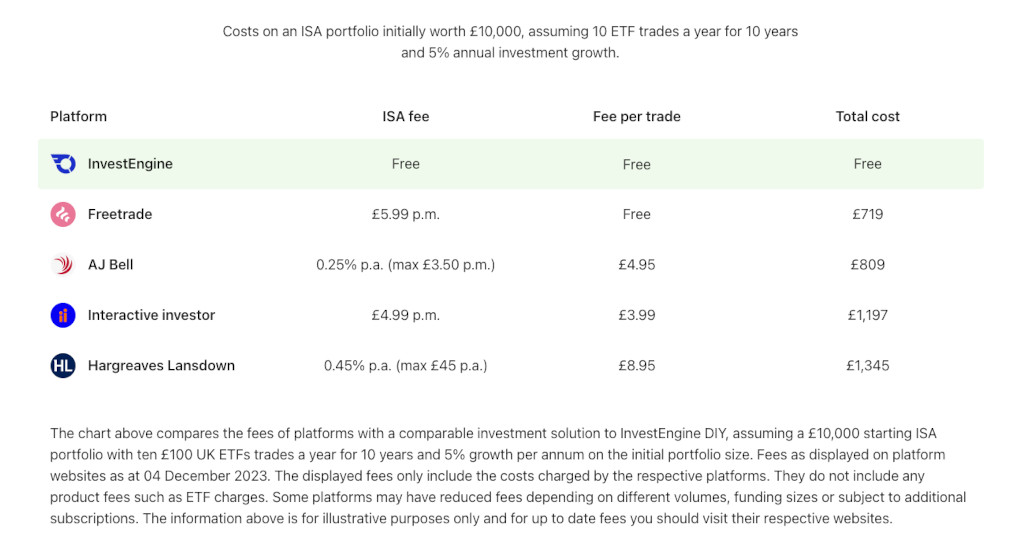

You can find a cost comparison on Invest Engine’s website but this is more of an illustrative marketing tool and doesn’t include comparable vendors such as Trading 212 who offer a similar low cost investment platform.

It is important to note that your ETFs will incur costs, and this is independent of Invest Engine. Every ETF has a series of fees associated with them which we explain in the little more detail in our blog about how to pick the perfect ETF.

Is Invest Engine Legit?

So is Invest Engine legitimate? Is Invest Engine too good to be true?

Invest Engine is regulated by the FCA, is backed with FSCS protection, makes the fees transparent and clear and have a clear business strategy.

Whilst Invest Engine is not turning a profit currently, the company has been in business for 5 years now and is growing quickly, but not too far beyond its means. Through Invest Engine you can invest in globally popular ETFs. Even if Invest Engine goes bust, you’ll still be the holder of the underlying assets and Invest Engine has no claim over them.

Whilst it will be inconvenient if Invest Engine collapses, it’s a risk with any investment platform or bank. You won’t lose money.

Invest Engine are legitimate and whilst we’ve all been warned about things that sound too good to be true, in this case Invest Engine are doing everything right. The only thing they can really do to improve their offering is grow their reputation, which will come with time, and start turning a profit to increase customer confidence in their business model.

Should You Invest With Invest Engine?

Invest Engine only offer ETFs, so if you want to invest in individual stocks then this platform is not for you. They have a growing range of ETFs, currently over 650, all listed on the London Stock Exchange and listed in GBP, so there are no foreign exchange fees to worry about.

They are a low cost investment platform that rivals the best out there. If you want the history of a larger investing institution then Invest Engine is not for you, but you will pay a premium for that. If you want a cost effective solution to grow your wealth then Invest engine is a great option that I can personally recommend.